Any analysis of retail data over the last three years needs to investigate the impact of the coronavirus pandemic on consumer spending behaviour. There are, of course, clear first-order effects, such as significant increases in traffic and orders via ecommerce, and significant reductions in footfall to shopping centres and malls. At its worst, research from the British Retail Consortium shows that footfall to retail parks declined 67%.

Upside’s unique insight into consumer spending behaviour gives a glimpse at the second-order effects of the pandemic. Given the granularity and richness of Open Banking data, we sought to understand what was happening to customer loyalty at an individual customer-level. We analysed the transition between loyalty levels (e.g. “not loyal” -> loyal, or VVIP -> VIP) and were also able to capture new customer acquisitions (not a customer -> “not loyal”) and the lapsing of existing customers (loyal -> not a customer).

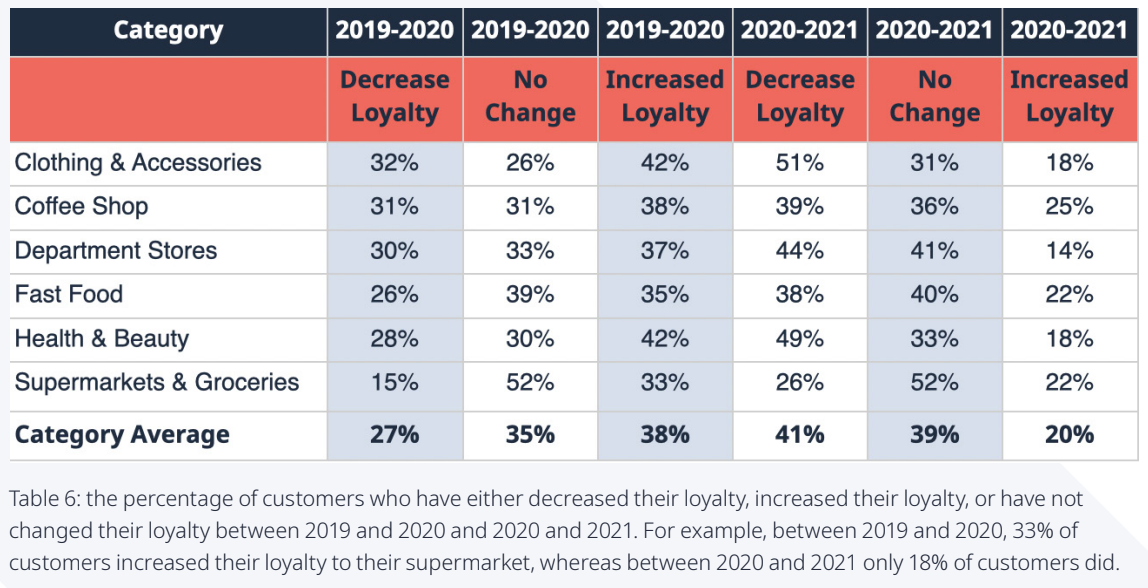

The above table suggests, on average, 35% of customers did not shift their loyalty between 2019 and 2020; this number increases slightly to 39% if we consider the behaviour change post-pandemic, from 2020 to 2021. As might be expected, owing to the lack of options during the pandemic, 38% of customers have a perceived increase in loyalty between 2019 and 2020. However, as the world opens up and consumers have more choice again, we see a 41% decrease in loyalty between 2020 and 2021. In reality, this perceived increase or decrease in loyalty is likely a result of a lack of options during the pandemic; consumers weren’t able to shop in-store and, with online delivery slots scarce, people likely shopped wherever they could to get what they needed.

There are no standout categories that have managed to continue to increase customer loyalty post-pandemic, with all categories seeing a bigger decrease in loyalty rather than a gain. When looked at through this lens, we see a bigger reduction in loyalty owing to the fact that we are able to capture new customer acquisitions and, importantly in this case, customers lapsing with retailers as we ease out of the pandemic.

Thus, it is fair to say that customers are now less loyal than before the pandemic; this explains the increase year-on-year in the “loyalty tipping point,’ requiring customers to spend more, and more frequently, to transition from being “not loyal” to loyal to a retailer.