Shop

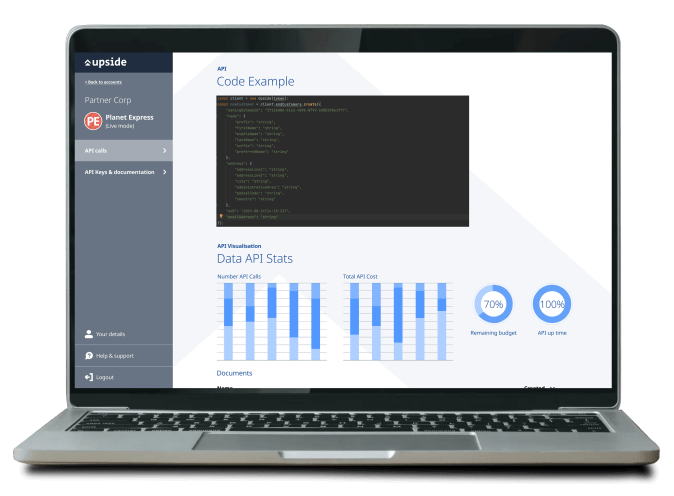

Introducing Minerva, Upside’s proprietary artificial intelligence that sits under the hood of the Upside Reward API. Minerva matches banking transactions to valid cashback offers to power the next evolution in cashback and rewards.

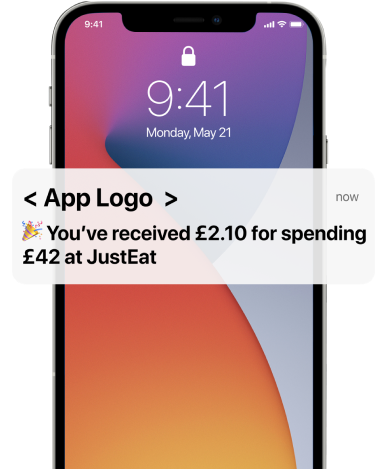

No links to click, no cookies to track, no voucher codes to use. Just frictionless cashback and high quality engagement between you and your users.

There are over 70 retailer offers live in the platform today, with more being added every week. With our API-first solution, you have full control over the front-end experience you want to provide.